THE BUTTERFLY EFFECT

The butterfly effect is an often misunderstood phenomenon wherein a small change in starting conditions can lead to vastly different outcomes. Understanding the butterfly effect can give us a new lens through which to view business, markets, and more.

***

“You could not remove a single grain of sand from its place without thereby … changing something throughout all parts of the immeasurable whole.”

— Fichte, The Vocation of Man (1800)

***

In one of Stephen King’s greatest works, 11/22/63, a young man named Jake discovers a portal in a diner’s pantry which leads back to 1958. After a few visits and some experiments, Jake deduces that altering history is possible. However long he stays in the past, only two minutes go by in the present. He decides to live in the past until 1963 so he can prevent the assassination of President John F. Kennedy, believing that this change will greatly benefit humanity. After years of stalking Lee Harvey Oswald, Jake manages to prevent him from shooting Kennedy.

Upon returning to the present, he expects to find the world improved as a result. Instead, the opposite has happened. Earthquakes occur everywhere, his old home is in ruins, and nuclear war has destroyed much of the world. (As King wrote in an article for Marvel Spotlight, “Not good to fool with Father Time.”) Distraught, Jake returns to 1958 once again and resets history.

In addition to being a masterful work of speculative fiction, 11/22/63 is a classic example of how everything in the world is connected together.

The butterfly effect is the idea that small things can have non-linear impacts on a complex system. The concept is imagined with a butterfly flapping its wings and causing a typhoon.

Of course, a single act like the butterfly flapping its wings cannot cause a typhoon. Small events can, however, serve as catalysts that act on starting conditions.

And as John Gribbin writes in his cult-classic work Deep Simplicity, “some systems … are very sensitive to their starting conditions, so that a tiny difference in the initial ‘push’ you give them causes a big difference in where they end up, and there is feedback, so that what a system does affects its own behavior.”

In the foreword to The Butterfly Effect in Competitive Markets by Dr. Rajagopal, Tom Breuer writes:

Simple systems, with few variables, can nonetheless show unpredictable and sometimes chaotic behavior…[Albert] Libchaber conducted a series of seminal experiments. He created a small system in his lab to study convection (chaotic system behavior) in a cubic millimeter of helium. By gradually warming this up from the bottom, he could create a state of controlled turbulence. Even this tightly controlled environment displayed chaotic behavior: complex unpredictable disorder that is paradoxically governed by “orderly” rules.

… [A] seemingly stable system (as in Libchaber’s 1 ccm cell of helium) can be exposed to very small influences (like heating it up a mere 0.001 degree), and can transform from orderly convection into wild chaos. Although [such systems are] governed by deterministic phenomena, we are nonetheless unable to predict how [they] will behave over time.

What the Butterfly Effect Is Not

The point of the butterfly effect is not to get leverage. As General Stanley McChrystal writes in Team of Teams:

In popular culture, the term “butterfly effect” is almost always misused. It has become synonymous with “leverage”—the idea of a small thing that has a big impact, with the implication that, like a lever, it can be manipulated to a desired end. This misses the point of Lorenz’s insight. The reality is that small things in a complex system may have no effect or a massive one, and it is virtually impossible to know which will turn out to be the case.

Benjamin Franklin offered a poetic perspective in his variation of a proverb that’s been around since the 14th century in English and the 13th century in German, long before the identification of the butterfly effect:

For want of a nail the shoe was lost,

For want of a shoe the horse was lost,

For want of a horse the rider was lost,

For want of a rider the battle was lost,

For want of a battle the kingdom was lost,

And all for the want of a horseshoe nail.

The lack of one horseshoe nail could be inconsequential, or it could indirectly cause the loss of a war. There is no way to predict which outcome will occur. (If you want an excellent kids book to start teaching this to your children, check out If You Give a Mouse a Cookie.)

In this post, we will seek to unravel the butterfly effect from its many incorrect connotations, and build an understanding of how it affects our individual lives and the world in general.

Edward Lorenz and the Discovery of the Butterfly Effect

“It used to be thought that the events that changed the world were things like big bombs, maniac politicians, huge earthquakes, or vast population movements, but it has now been realized that this is a very old-fashioned view held by people totally out of touch with modern thought. The things that change the world, according to Chaos theory, are the tiny things. A butterfly flaps its wings in the Amazonian jungle, and subsequently a storm ravages half of Europe.”

— from Good Omens, by Terry Pratchett and Neil Gaiman

***

Although the concept of the butterfly effect has long been debated, the identification of it as a distinct effect is credited to Edward Lorenz (1917–2008). Lorenz was a meteorologist and mathematician who successfully combined the two disciplines to create chaos theory. During the 1950s, Lorenz searched for a means of predicting the weather, as he found linear models to be ineffective.

In an experiment to model a weather prediction, he entered the initial condition as 0.506, instead of 0.506127. The result was surprising: a somewhat different prediction. From this, he deduced that the weather must turn on a dime. A tiny change in the initial conditions had enormous long-term implications. By 1963, he had formulated his ideas enough to publish an award-winning paper entitled Deterministic Nonperiodic Flow. In it, Lorenz writes:

Subject to the conditions of uniqueness, continuity, and boundedness … a central trajectory, which in a certain sense is free of transient properties, is unstable if it is nonperiodic. A noncentral trajectory … is not uniformly stable if it is nonperiodic, and if it is stable at all, its very stability is one of its transient properties, which tends to die out as time progresses. In view of the impossibility of measuring initial conditions precisely, and thereby distinguishing between a central trajectory and a nearby noncentral trajectory, all nonperiodic trajectories are effectively unstable from the point of view of practical prediction.

In simpler language, he theorized that weather prediction models are inaccurate because knowing the precise starting conditions is impossible, and a tiny change can throw off the results. To make the concept understandable to non-scientific audiences, Lorenz began to use the butterfly analogy.

In speeches and interviews, he explained that a butterfly has the potential to create tiny changes which, while not creating a typhoon, could alter its trajectory. A flapping wing represents the minuscule changes in atmospheric pressure, and these changes compound as a model progresses. Given that small, nearly imperceptible changes can have massive implications in complex systems, Lorenz concluded that attempts to predict the weather were impossible. Elsewhere in the paper, he writes:

If, then, there is any error whatever in observing the present state—and in any real system such errors seem inevitable—an acceptable prediction of an instantaneous state in the distant future may well be impossible.

… In view of the inevitable inaccuracy and incompleteness of weather observations, precise very-long-range forecasting would seem to be nonexistent.

Lorenz always stressed that there is no way of knowing what exactly tipped a system. The butterfly is a symbolic representation of an unknowable quantity.

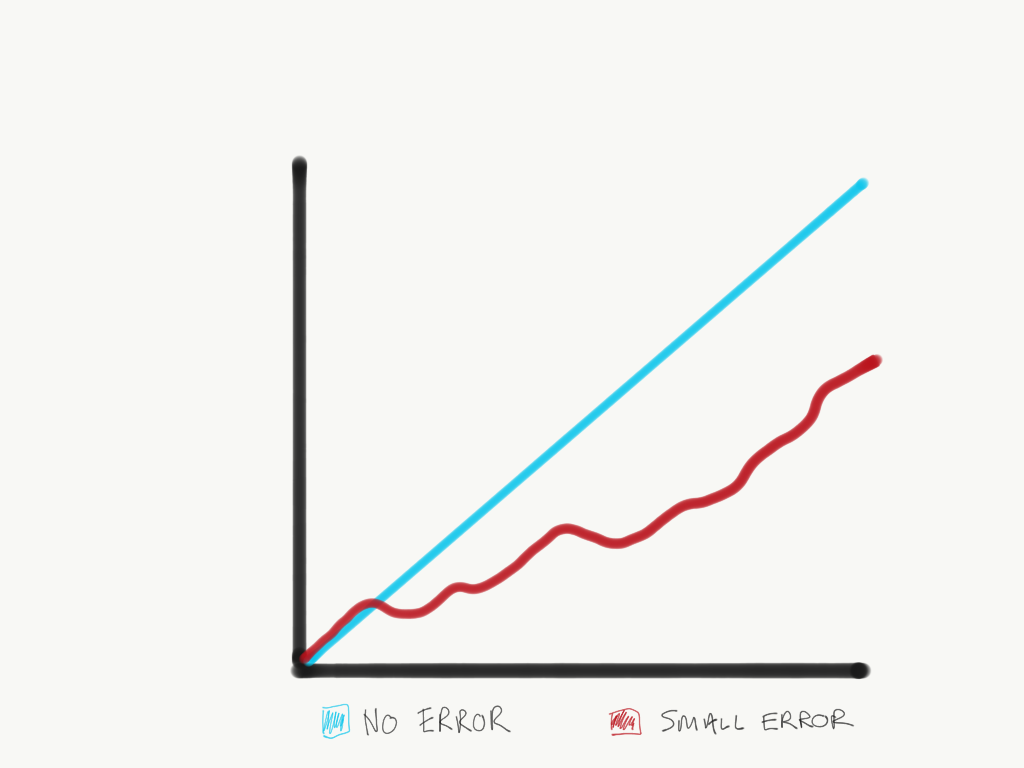

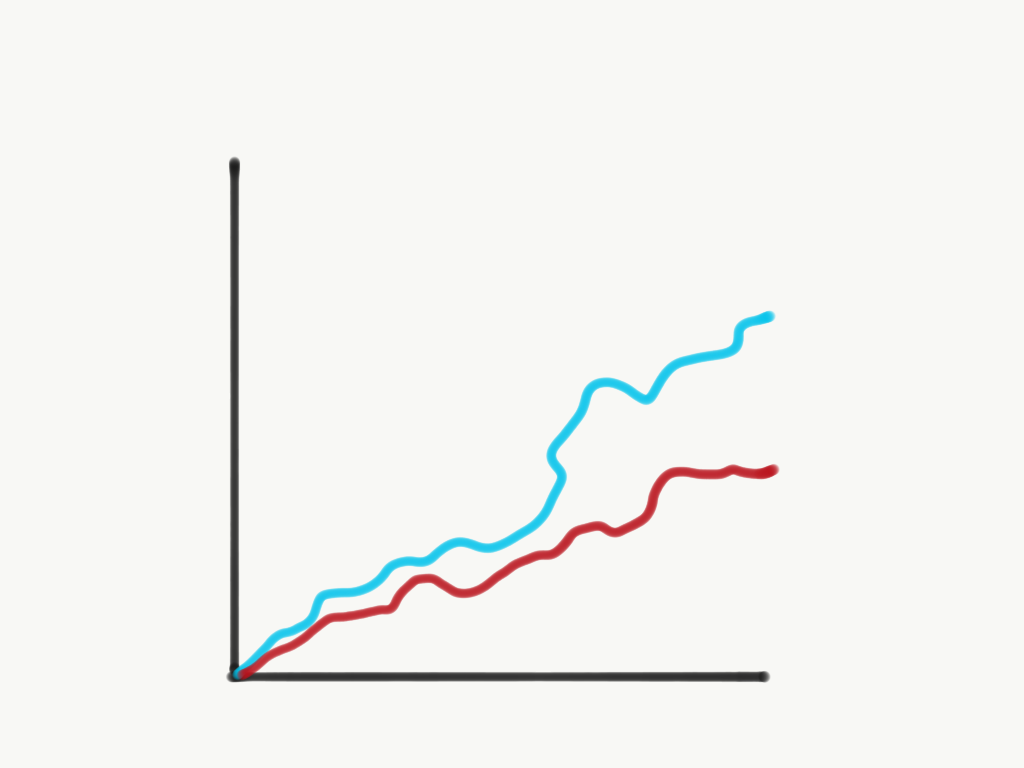

Furthermore, he aimed to contest the use of predictive models that assume a linear, deterministic progression and ignore the potential for derailment. Even the smallest error in an initial setup renders the model useless as inaccuracies compound over time. The exponential growth of errors in a predictive model is known as deterministic chaos. It occurs in most systems, regardless of their simplicity or complexity.

The butterfly effect is somewhat humbling—a model that exposes the flaws in other models. It shows science to be less accurate than we assume, as we have no means of making accurate predictions due to the exponential growth of errors.

Before the work of Lorenz, people assumed that an approximate idea of initial conditions would lead to an approximate prediction of the outcome. In Chaos: Making a New Science, James Gleick writes:

The models would churn through complicated, somewhat arbitrary webs of equations, meant to turn measurements of initial conditions … into a simulation of future trends. The programmers hoped the results were not too grossly distorted by the many unavoidable simplifying assumptions. If a model did anything too bizarre … the programmers would revise the equations to bring the output back in line with expectation… Models proved dismally blind to what the future would bring, but many people who should have known better acted as though they believed the results.

One theoretician declared, “The basic idea of Western science is that you don’t have to take into account the falling of a leaf on some planet in another galaxy when you’re trying to account for the motion of a billiard ball on a pool table on earth.”

Lorenz’s findings were revolutionary because they proved this assumption to be entirely false. He found that without a perfect idea of initial conditions, predictions are useless—a shocking revelation at the time.

During the early days of computers, many people believed they would enable us to understand complex systems and make accurate predictions. People had been slaves to weather for millennia, and now they wanted to take control. With one innocent mistake, Lorenz shook the forecasting world, sending ripples which (appropriately) spread far beyond meteorology.

Ray Bradbury, the Butterfly Effect, and the Arrow of Time

Ray Bradbury’s classic science fiction story A Sound of Thunder predates the identification of chaos theory and the butterfly effect. Set in 2055, it tells of a man named Eckels who travels back 65 million years to shoot a dinosaur. Warned not to deviate from the tour guide’s plan, Eckels (along with his guide and the guide’s assistant) heads off to kill a Tyrannosaurus Rex who was going to die soon anyway when a falling tree lands on it. Eckels panics at the sight of the creature and steps off the path, leaving his guide to kill the T Rex. The guide is enraged and orders Eckels to remove the bullets before the trio returns to 2055. Upon arrival, they are confused to find that the world has changed. Language is altered, and an evil dictator is now in charge. A confused Eckels notices a crushed butterfly stuck to his boot and realizes that in stepping off the path, he killed the insect and changed the future. Bradbury writes:

Eckels felt himself fall into a chair. He fumbled crazily at the thick slime on his boots. He held up a clod of dirt, trembling, “No, it cannot be. Not a little thing like that. No!”

Embedded in the mud, glistening green and gold and black, was a butterfly, very beautiful and very dead.

“Not a little thing like that! Not a butterfly!” cried Eckels.

It fell to the floor, an exquisite thing, a small thing that could upset balances and knock down a line of small dominoes and then big dominoes and then gigantic dominoes, all down the years across Time. Eckels’ mind whirled. It couldn’t change things. Killing one butterfly couldn’t be that important! Could it?

Bradbury envisioned the passage of time as fragile and liable to be disturbed by minor changes. In the decades since the publication of A Sound of Thunder, physicists have examined its accuracy. Obviously, we cannot time–travel, so there is no way of knowing how plausible the story is, beyond predictive models. Bradbury’s work raises the questions of what time is and whether it is deterministic.

Physicists refer to the Arrow of Time—the non-reversible progression of entropy (disorder.) As time moves forward, matter becomes more and more chaotic and does not spontaneously return to its original state. If you break an egg, it remains broken and cannot spontaneously re-form, for example. The Arrow of Time gives us a sense of past, present, and future. Arthur Eddington (the astronomer and physicist who coined the term) explained:

Let us draw an arrow arbitrarily. If as we follow the arrow we find more and more of the random element in the state of the world, then the arrow is pointing towards the future; if the random element decreases the arrow points towards the past. That is the only distinction known to physics. This follows at once if our fundamental contention is admitted that the introduction of randomness is the only thing which cannot be undone.

In short, the passage of time as we perceive it does exist, conditional to the existence of entropy. As long as entropy is non-reversible, time can be said to exist. The closest thing we have to a true measurement of time is a measurement of entropy. If the progression of time is nothing but a journey towards chaos, it makes sense for small changes to affect the future by amplifying chaos.

We do not yet know if entropy creates time or is a byproduct of it. Subsequently, we cannot know if changing the past would change the future. Would stepping on a butterfly shift the path of entropy? Did Eckels move off the path out of his own free will, or was that event predetermined? Was the dictatorial future he returned to always meant to be?

These interconnected concepts — the butterfly effect, chaos theory, determinism, free will, time travel — have captured many imaginations since their discoveries. Films ranging from It’s a Wonderful Life to Donnie Darko and the eponymous Butterfly Effect have explored the complexities of cause and effect. Once again, it is important to note that works of fiction tend to view the symbolic butterfly as the cause of an effect. According to Lorenz’s original writing, though, the point is that small details can tip the balance without being identifiable.

The Butterfly Effect in Business

Marketplaces are, in essence, chaotic systems that are influenced by tiny changes. This makes it difficult to predict the future, as the successes and failures of businesses can appear random. Periods of economic growth and decline sprout from nowhere. This is the result of the exponential impact of subtle stimuli—the economic equivalent of the butterfly effect. Breuer explains:

We live in an interconnected, or rather a hyper-connected society. Organizations and markets “behave” like networks. This triggers chaotic (complex) rather than linear behavior.

Preparing for the future and seeing the logic in the chaos of consumer behavior is not easy. Once-powerful giants collapse as they fall behind the times. Tiny start-ups rise from the ashes and take over industries. Small alterations in existing technology transform how people live their lives. Fads capture everyone’s imagination, then disappear.

Businesses have two options in this situation: build a timeless product or service, or race to keep up with change. Many businesses opt for a combination of the two. For example, Doc Martens continues selling the classic 1460 boot, while bringing out new designs each season. This approach requires extreme vigilance and attention to consumer desires in an attempt to both remain relevant and appear timeless. Businesses leverage the compounding impact of small tweaks that aim to generate interest in all they have to offer.

In The Butterfly Effect in Competitive Markets, Dr. Rajagopal writes that

most global firms are penetrating bottom-of-the-pyramid market segments by introducing small changes in technology, value perceptions, [and] marketing-mix strategies, and driving production on an unimagined scale of magnitude to derive a major effect on markets. …Procter & Gamble, Kellogg’s, Unilever, Nestlé, Apple, and Samsung, have experienced this effect in their business growth… Well-managed companies drive small changes in their business strategies by nipping the pulse of consumers…

Most firms use such effect by making a small change in their strategy in reference to produce, price, place, promotion, … posture (developing corporate image), and proliferation…to gain higher market share and profit in a short span.

For most businesses, incessant small changes are the most effective way to produce the metaphorical typhoon. These iterations keep consumers engaged while preserving brand identity. If these small tweaks fail, the impact is hopefully not too great. But if they succeed and compound, the rewards can be monumental.

By nature, all markets are chaotic, and what seem like inconsequential alterations can propel a business up or down. Rajagopal explains how the butterfly effect connects to business:

Globalization and frequent shifts in consumer preferences toward products and services have accelerated chaos in the market due to the rush of firms, products, and business strategies. Chaos theory in markets addresses the behavior of strategic and dynamic moves of competing firms that are highly sensitive to existing market conditions triggering the butterfly effect.

The initial conditions (economic, social, cultural, political) in which a business sets up are vital influences on its success or failure. Lorenz found that the smallest change in the preliminary conditions created a different outcome in weather predictions, and we can consider the same to be true for businesses. The first few months and years are a crucial time when rates of failure are highest and the basic brand identity forms. Any of the early decisions, achievements, or mistakes have the potential to be the wing flap that creates a storm.

Benoit Mandelbrot on the Butterfly Effect in Economics

International economies can be thought of as a single system, wherein each part influences the others. Much like the atmosphere, the economy is a complex system in which we see only the visible outcomes—rain or shine, boom, or bust. With the advent of globalization and improved communication technology, the economy is even more interconnected than in the past. One episode of market volatility can cause problems for the entire system. The butterfly effect in economics refers to the compounding impact of small changes. As a consequence, it is nearly impossible to make accurate predictions for the future or to identify the precise cause of an inexplicable change. Long periods of stability are followed by sudden declines and vice versa.

Benoit Mandelbrot (the “father of fractals”) began applying the butterfly effect to economics several decades ago. In a 1999 article for Scientific American, he explained his findings. Mandelbrot saw how unstable markets could be, and he cited an example of a company which saw its stock drop 40% in one day, followed by another 6%, before rising by 10%—the typhoon created by an unseen butterfly. When Benoit looked at traditional economic models, he found that they did not even allow for the occurrence of such events. Standard models denied the existence of dramatic market shifts. Benoit writes in Scientific American:

According to portfolio theory, the probability of these large fluctuations would be a few millionths of a millionth of a millionth of a millionth. (The fluctuations are greater than 10 standard deviations.) But in fact, one observes spikes on a regular basis—as often as every month—and their probability amounts to a few hundredths.

If these changes are unpredictable, what causes them? Mandelbrot’s answer lay in his work on fractals. To explain fractals would require a whole separate post, so we will go with Mandelbrot’s own simplified description: “A fractal is a geometric shape that can be separated into parts, each of which is a reduced-scale version of the whole.” He goes on to explain the connection:

In finance, this concept is not a rootless abstraction but a theoretical reformulation of a down-to-earth bit of market folklore—namely that movements of a stock or currency all look alike when a market chart is enlarged or reduced so that it fits the same time and price scale. An observer then cannot tell which of the data concern prices that change from week to week, day to day or hour to hour. This quality defines the charts as fractal curves and makes available many powerful tools of mathematical and computer analysis.”

In a talk, Mandelbrot held up his coffee and declared that predicting its temperature in a minute is impossible, but in an hour is perfectly possible. He applied the same concept to markets that change in dramatic ways in the short term. Even if a long-term pattern can be deduced, it has little use for those who trade on a shorter timescale.

Mandelbrot explains how his fractals can be used to create a more useful model of the chaotic nature of the economy:

Instead, multifractals can be put to work to “stress-test” a portfolio. In this technique, the rules underlying multifractals attempt to create the same patterns of variability as do the unknown rules that govern actual markets. Multifractals describe accurately the relation between the shape of the generator and the patterns of up-and-down swings of prices to be found on charts of real market data… They provide estimates of the probability of what the market might do and allow one to prepare for inevitable sea changes. The new modeling techniques are designed to cast a light of order into the seemingly impenetrable thicket of the financial markets. They also recognize the mariner’s warning that, as recent events demonstrate, deserves to be heeded: On even the calmest sea, a gale may be just over the horizon.

In The Misbehaviour of Markets, Mandelbrot and Richard Hudson expand upon the topic of financial chaos. They begin with a discussion of the infamous 2008 crash and its implications:

The worldwide market crash of autumn 2008 had many causes: greedy bankers, lax regulators and gullible investors, to name a few. But there is also a less-obvious cause: our all-too-limited understanding of how markets work, how prices move and how risks evolve. …

Markets are complex, and treacherous. The bone-chilling fall of September 29, 2008—a 7 percent, 777 point plunge in the Dow Jones Industrial Average—was, in historical terms, just a particularly dramatic demonstration of that fact. In just a few hours, more than $1.6 trillion was wiped off the value of American industry—$5 trillion worldwide.

Mandelbrot and Hudson believe that the 2008 credit crisis can be attributed in part to the increasing confidence in financial predictions. People who created computer models designed to guess the future failed to take into account the butterfly effect. No matter how complex the models became, they could not create a perfect picture of initial conditions or account for the compounding impact of small changes. Just as people believed they could predict and therefore control the weather before Lorenz published his work, people thought they could do the same for markets until the 2008 crash proved otherwise. Wall Street banks trusted their models of the future so much that they felt safe borrowing growing sums of money for what was, in essence, gambling. After all, their predictions said such a crash was impossible. Impossible or not, it happened.

According to Mandelbrot and Hudson, predictive models view markets as “a risky but ultimately … manageable world.” As with meteorology, economic predictions are based on approximate ideas of initial conditions—ideas that, as we know, are close to useless. As Mandelbrot and Hudson write:

[Causes are usually obscure. … The precise market mechanism that links news to price, cause to effect, is mysterious and seems inconsistent. Threat of war: Dollar falls. Threat of war: Dollar rises. Which of the two will actually happen? After the fact, it seems obvious; in hindsight, fundamental analysis can be reconstituted and is always brilliant. But before the fact, both outcomes may seem equally likely.

In the same way that apparently similar weather conditions can create drastically different outcomes, apparently similar market conditions can create drastically different outcomes. We cannot see the extent to which the economy is interconnected, and we cannot identify where the butterfly lies. Mandelbrot and Hudson disagree with the view of the economy as separate from other parts of our world. Everything connects:

No one is alone in this world. No act is without consequences for others. It is a tenet of chaos theory that, in dynamical systems, the outcome of any process is sensitive to its starting point—or in the famous cliché, the flap of a butterfly’s wings in the Amazon can cause a tornado in Texas. I do not assert that markets are chaotic…. But clearly, the global economy is an unfathomably complicated machine. To all the complexity of the physical world… you add the psychological complexity of men acting on their fleeting expectations….

Why do people prefer to blame crashes (such as the 2008 credit crisis) on the folly of those in the financial industry? Jonathan Cainer provides a succinct explanation:

Why do we love the idea that people might be secretly working together to control and organize the world? Because we do not like to face the fact that our world runs on a combination of chaos, incompetence, and confusion.

Historic Examples of the Butterfly Effect

“A very small cause which escapes our notice determines a considerable effect that we cannot fail to see, and then we say the effect is due to chance. If we knew exactly the laws of nature and the situation of the universe at the initial moment, we could predict exactly the situation of that same universe at a succeeding moment. But even if it were the case that the natural laws had no longer any secret for us, we could still only know the initial situation *approximately*. If that enabled us to predict the succeeding situation with *the same approximation*, that is all we require, and we should say that the phenomenon had been predicted, that it is governed by laws. But it is not always so; it may happen that small differences in the initial conditions produce very great ones in the final phenomena. A small error in the former will produce an enormous error in the latter. Prediction becomes impossible, and we have the fortuitous phenomenon.”

— Jules Henri Poincaré (1854–1912)

***

Many examples exist of instances where a tiny detail led to a dramatic change. In each case, the world we live in could be different if the situation had been reversed. Here are some examples of how the butterfly effect has shaped our lives.

- The bombing of Nagasaki. The US initially intended to bomb the Japanese city of Kuroko, with the munitions factory as a target. On the day the US planned to attack, cloudy weather conditions prevented the factory from being seen by military personnel as they flew overhead. The airplane passed over the city three times before the pilots gave up. Locals huddled in shelters heard the hum of the airplane preparing to drop the nuclear bomb and prepared for their destruction. Except Kuroko was never bombed. Military personnel decided on Nagasaki as the target due to improved visibility. The implications of that split-second decision were monumental. We cannot even begin to comprehend how different history might have been if that day had not been cloudy. Kuroko is sometimes referred to as the luckiest city in Japan, and those who lived there during the war are still shaken by the near-miss.

- The Academy of Fine Arts in Vienna rejecting Adolf Hitler’s application, twice. In the early 1900s, a young Hitler applied for art school and was rejected, possibly by a Jewish professor. By his own estimation and that of scholars, this rejection went on to shape his metamorphosis from an aspiring bohemian artist into the human manifestation of evil. We can only speculate as to how history would have been different. But it is safe to assume that a great deal of tragedy could have been avoided if Hitler had applied himself to water colors, not to genocide.

- The assassination of Archduke Franz Ferdinand. A little-known fact about the event considered to be the catalyst for both world wars is that it almost didn’t happen. On the 28th of June, 1914, a teenage Bosnian-Serb named Gavrilo Princip went to Sarajevo with two other nationalists to assassinate the Archduke. The initial assassination attempt failed; a bomb or grenade exploded beneath the car behind the Archduke’s and wounded its occupants. The route was supposed to have been changed after that, but the Archduke’s driver didn’t get the message. Had he actually taken the alternate route, Princip would not have been on the same street as the car and would not have had the chance to shoot the Archduke and his wife that day. Were it not for a failure of communication, both world wars might never have happened.

- The Chernobyl disaster. In 1986, a test at the Chernobyl nuclear plant went awry and released 400 times the radiation produced by the bombing of Hiroshima. One hundred fifteen thousand people were evacuated from the area, with many deaths and birth defects resulting from the radiation. Even today, some areas remain too dangerous to visit. However, it could have been much worse. After the initial explosion, three plant workers volunteered to turn off the underwater valves to prevent a second explosion. It has long been believed that the trio died as a result, although there is now some evidence this may not have been the case. Regardless, diving into a dark basement flooded with radioactive water was a heroic act. Had they failed to turn off the valve, half of Europe would have been destroyed and rendered uninhabitable for half a million years. Russia, Ukraine, and Kiev also would have become unfit for human habitation. Whether they lived or not, the three men—Alexei Ananenko, Valeri Bezpalov, and Boris Baranov—stilled the wings of a deadly butterfly. Indeed, the entire Chernobyl disaster was the result of poor design and the ineptitude of staff. The long-term result (in addition to the impact on residents of the area) was widespread anxiety towards nuclear plants and bias against nuclear power, leading to a preference for fossil fuels. Some people have speculated that Chernobyl is responsible for the acceleration of global warming, as countries became unduly slow to adopt nuclear power.

- The Cuban Missile Crisis. We all may owe our lives to a single Russian Navy officer named Vasili Arkhipov, who has been called “the man who saved the world.” During the Cuban Missile Crisis, Arkhipov was stationed on a nuclear-armed submarine near Cuba. American aircraft and ships began using depth charges to signal the submarine that it should surface so it could be identified. With the submarine submerged too deep to monitor radio signals, the crew had no idea what was going on in the world above. The captain, Savitsky, decided the signal meant that war had broken out and he prepared to launch a nuclear torpedo. Everyone agreed with him—except Arkhipov. Had the torpedo launched, nuclear clouds would have hit Moscow, London, East Anglia and Germany, before wiping out half of the British population. The result could have been a worldwide nuclear holocaust, as countries retaliated and the conflict spread. Yet within an overheated underwater room, Arkhipov exercised his veto power and prevented a launch. Without the courage of one man, our world could be unimaginably different.

From these handful of examples, it is clear how fragile the world is, and how dire the effects of tiny events can be on starting conditions.

We like to think we can predict the future and exercise a degree of control over powerful systems such as the weather and the economy. Yet the butterfly effect shows that we cannot. The systems around us are chaotic and entropic, prone to sudden change. For some kinds of systems, we can try to create favorable starting conditions and be mindful of the kinds of catalysts that might act on those conditions – but that’s as far as our power extends. If we think that we can identify every catalyst and control or predict outcomes, we are only setting ourselves up for a fall.